尊敬的用户您好,这是来自manbetx20客户端下载

的温馨提示:如您对更多manbetx20客户端下载

的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“manbetx20客户端下载

”,下载manbetx20客户端下载

的官方应用。

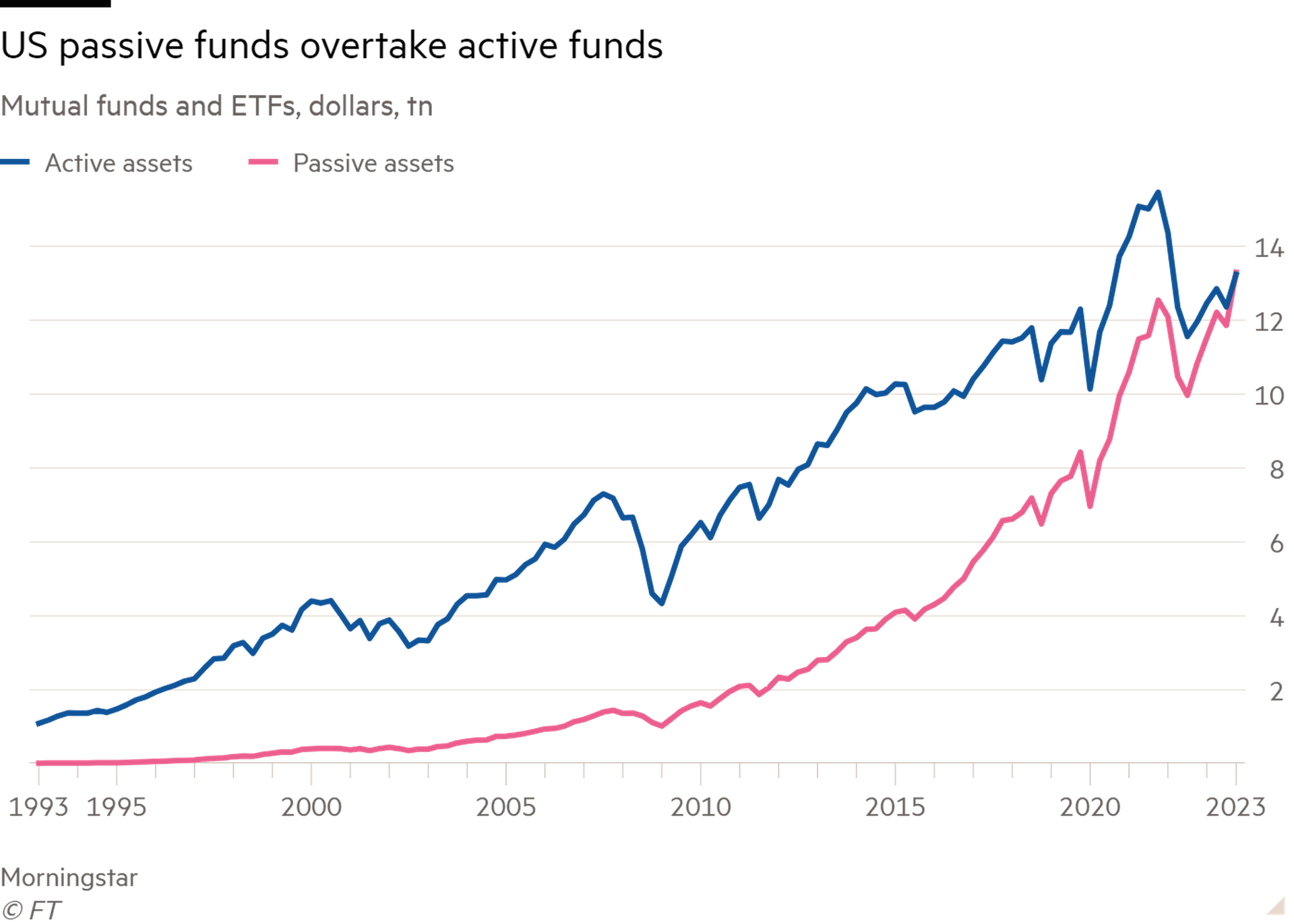

“Don’t look for the needle in the haystack. Just buy the haystack,” wrote John Bogle, the late founder of investment firm Vanguard. His quip is now conventional wisdom. America’s passively managed mutual funds and exchange traded funds — which mimic overall market indices — ended last year with more assets than active ones, following years of strong inflows.

“不要在干草堆里找针。只需买下整个干草堆。” 先锋集团创始人约翰•博格尔(John Bogle)曾写道。他的俏皮话现在已成为常识。美国的被动管理型共同基金和交易所交易基金(模仿整体市场指数)在经历多年的大量资金流入后,去年以更多的资产结束,超过了主动管理型基金。

Though many still tout their stock and bond picking credentials, active fund managers only rarely generate alpha (or market-beating returns). In the long term the index tends to win, substantiating Bogle’s advice. So, why risk money hoping to unearth the next Google or Amazon when it is both safer and more lucrative to be invested in everything?

尽管许多人仍然吹嘘他们在股票和债券选择方面的资质,但主动基金经理很少能够创造超额收益(或者说超越市场回报)。从长期来看,指数往往获胜,证实了博格尔的建议。那么,为什么要冒着风险去寻找下一个谷歌(Google)或亚马逊(Amazon),当投资于一切都更安全且更有利可图呢?

That is the question active fund managers fear too many investors are now asking themselves. With the expansion of mutual index and ETF products — covering an array of assets and geographies — shifting cash into diversified trackers is simple. Investment apps allow it to be done with the flick of a finger. For households seeking to earn more from their savings, the growth of these low-cost investment vehicles is an unalloyed good.

这也是主动基金经理们担心现在有太多投资者在问自己的问题。随着共同指数和交易所交易基金(ETF)产品的扩大,涵盖了各种资产和地理区域,将资金转移到多元化的跟踪器中变得简单。投资应用程序使得这一切可以通过轻轻一点手指来完成。对于希望从储蓄中获得更多收益的家庭来说,这些低成本投资工具的增长是一件纯粹的好事。

Seeking out star or dud stocks is a costlier, more research-intensive exercise, and necessitates a higher fee-based business model. Poor long-term performance and the allure of cheaper passive strategies — which account for 40 per cent of the $45tn worldwide fund assets tracked by Morningstar, up from 14 per cent in 2008 — have eroded active managers’ inflows. Many are cutting costs and restructuring. In its annual results this week, Edinburgh-based Abrdn committed to axing 500 jobs amid large outflows.

寻找明星股票或失败股票是一项更昂贵、更需要研究的工作,需要更高的基于费用的商业模式。长期表现不佳和更便宜的被动策略的吸引力——这些策略占据了晨星追踪的manbetx app苹果

45万亿美元资金的40%,而2008年仅占14%——已经侵蚀了主动管理者的资金流入。许多人正在削减成本和进行重组。总部位于爱丁堡的Abrdn(Edinburgh-based Abrdn)在本周的年度业绩中承诺裁员500人,因为资金大量流出。

The industry and some economists worry that the continued flow of money into buy and hold funds could harm financial markets. Beyond a certain threshold, they argue, a lack of active traders engaged in weeding out over- or underpriced companies could lead to a greater misallocation of investors’ cash.

行业和一些manbetx20客户端下载

学家担心,持续流入买入并持有基金的资金可能会对金融市场造成伤害。他们认为,在某个阈值之后,缺乏积极交易者来清理过高或过低定价的公司,可能会导致投资者资金更大的错误配置。

For now this is just a theoretical concern. In practice, active managers still dominate the global industry. Finding alpha may be hard, particularly when markets are dominated by a few stocks, but opportunities have not suddenly disappeared. And big institutional investors, such as pension funds, still want to put their cash piles to work. Indeed, there remains plenty of interest in market-beating trades. For measure, hedge funds — which deploy higher-risk active strategies for accredited investors — currently outnumber Burger King outlets across the globe.

目前这只是一个理论上的担忧。实际上,主动管理者仍然主导着manbetx app苹果

行业。寻找Alpha可能很困难,特别是当市场被少数股票主导时,但机会并没有突然消失。而且,像养老基金这样的大型机构投资者仍然希望将他们的现金储备投入使用。事实上,对于能够在市场上获得超额收益的交易仍然存在很大的兴趣。以对冲基金为例,它们为合格投资者提供高风险主动策略,目前manbetx app苹果

数量超过了汉堡王(Burger King)门店。

This is a cut-throat industry. Active funds are competing with hard-to-beat passive strategies, and they are engaged in a zero-sum game with other active players. For each punt, there is a loser taking the other side of the bet. According to Morningstar, in the year to June 2023, 27 per cent of actively managed global large-cap equity funds beat the equivalent passive fund. Over a 15-year timeframe, only 3 per cent have. Active traders can hardly blame investors for switching to index strategies. To survive, they must prove they can actually make money.

这是一个竞争激烈的行业。主动基金正在与难以击败的被动策略竞争,并且他们与其他主动参与者进行零和游戏。对于每一次投注,都有一个输家承担着赌注的另一方。根据晨星的数据,在2023年6月的一年中,27%的manbetx app苹果

大型主动管理股票基金超过了相应的被动基金。在15年的时间范围内,只有3%的基金能够做到这一点。主动交易者几乎不能责怪投资者转向指数策略。为了生存,他们必须证明他们实际上能够赚钱。

Slashing fees, by cutting business costs, is one option to boost the odds of making market-beating returns. Some funds have also found greater chances of beating benchmarks in bond markets and more niche corners of the stock market. Others, like Citadel or DE Shaw, have hired the brightest quant minds or tried deploying tech — from AI to high-frequency trading — to find alpha. Today’s economic uncertainty and the potential for higher-for-longer interest rates should create the volatility that hawk-eyed traders can thrive on.

通过削减业务成本来降低费用是提高市场超额回报机会的一种选择。一些基金在债券市场和股票市场的更为专业领域中也发现了超越基准的更大机会。像城堡(Citadel)或德邵集团(DE Shaw)这样的公司则聘请了最优秀的量化分析师,或尝试运用从人工智能到高频交易的技术来寻找Alpha。如今的manbetx20客户端下载

不确定性和长期较高的利率可能会带来波动性,这将使眼光敏锐的交易员能够蓬勃发展。

Yet investors are unlikely to diverge from Bogle’s safe and sound advice without a good reason. That means if the stock pickers are to survive and thrive, they will have to work even harder to offer them one.

然而,投资者不太可能在没有充分理由的情况下偏离博格尔的安全可靠建议。这意味着如果股票选择者想要生存和繁荣,他们将不得不更加努力地为投资者提供一个理由。