In times of uncertainty, central bankers have often invoked the “Brainard conservatism principle”. Coined by economist William Brainard in 1967, it recommends that when monetary policymakers are unsure of the effects of their interest rate policies, they ought to react by less than they would with greater certainty. As the US Federal Reserve discusses whether to initiate the rate-cutting cycle with a reduction of 25 or 50 basis points at its meeting this week, the principle would appear to give a clear answer.

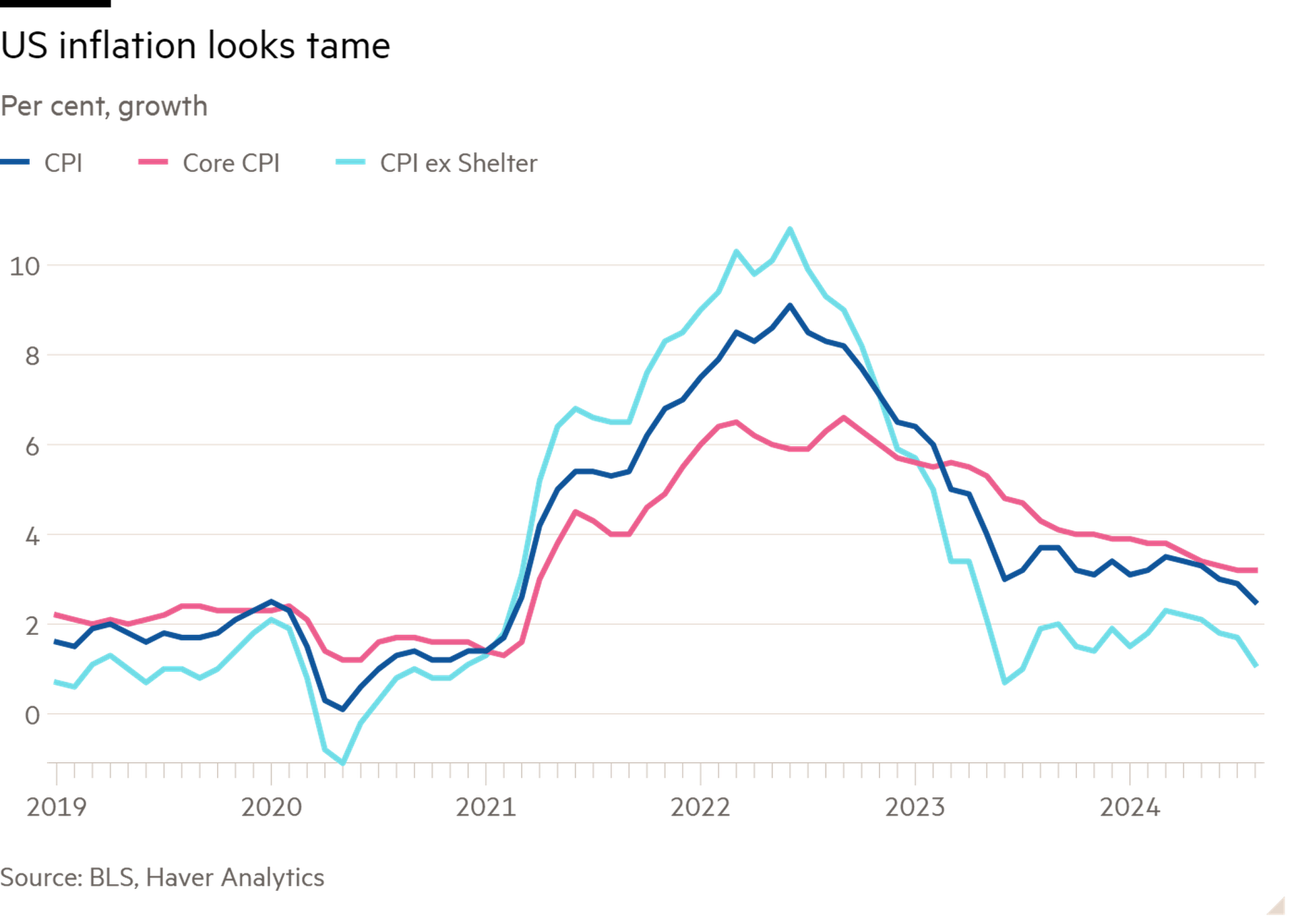

But caution is less relevant when the balance of risks to the Fed’s dual mandate — to achieve 2 per cent inflation, and support employment — are uneven. That may now be the case. The August consumer price index data showed annual price growth falling to just 2.5 per cent, in line with the Fed’s preferred PCE measure. The jobs market, however, is cooling rapidly. Non-farm payroll numbers have been revised down over the summer, the jobs opening rate is back near pre-pandemic levels and small business hiring plans are subdued.